Reimagining Retirement in a Post-COVID World

Building a Vision of a Better Future Self

In a Very Stressed World

Context

Hal Hershfield, a well-known behavioral finance professor, conducted a famous study many years ago. He found that when people could imagine a clear and positive picture of themselves ten years from now, they were more likely to favor saving over spending. 1 The pandemic and resulting events of 2020 have potentially rewritten the positive pictures people may have built for their future selves, in retirement.

Our virtual discussion forum

In a virtual forum on December 2, 2020, we talked about how to reorient the psychology of retirement savers in a new social and economic environment. We explored whether we can accomplish this by applying new technology, adopting new forms of storytelling, and/or changing the way we engage consumers. We will summarize the ideas discussed during this event and offer a path that helps all members of the retirement ecosystem to stop this generation of savers from endless "doomscrolling" and take positive action.

Current industry landscape

As we write this recap, COVID-19 cases continue to skyrocket across the country. Large parts of the country contemplate new versions of lockdowns to stop the spread of the virus. Fortunately, we look at the vaccines rolling out of the plants and do see an end in sight to the pandemic.

What happens when our industry gets the “all clear” signal from the CDC? We’ll all walk out to a very different world:

Demand for our products and services will likely see record levels. However, rates will likely still be at record lows. How do we deliver consumer value? As we write this document, a number of carriers consider completely stopping the sale of interest- sensitive retirement products. 2

Digital technology will have been adopted at record levels by seniors across the world. How do we engage with them? It probably isn’t in the living room. Major carriers have already announced plans to migrate wholesaling teams to primarily virtual models.

Most importantly for today’s discussion, yesterday’s confidence about a bright future in retirement has been shaken to the core.

The state of the retirement savers' minds

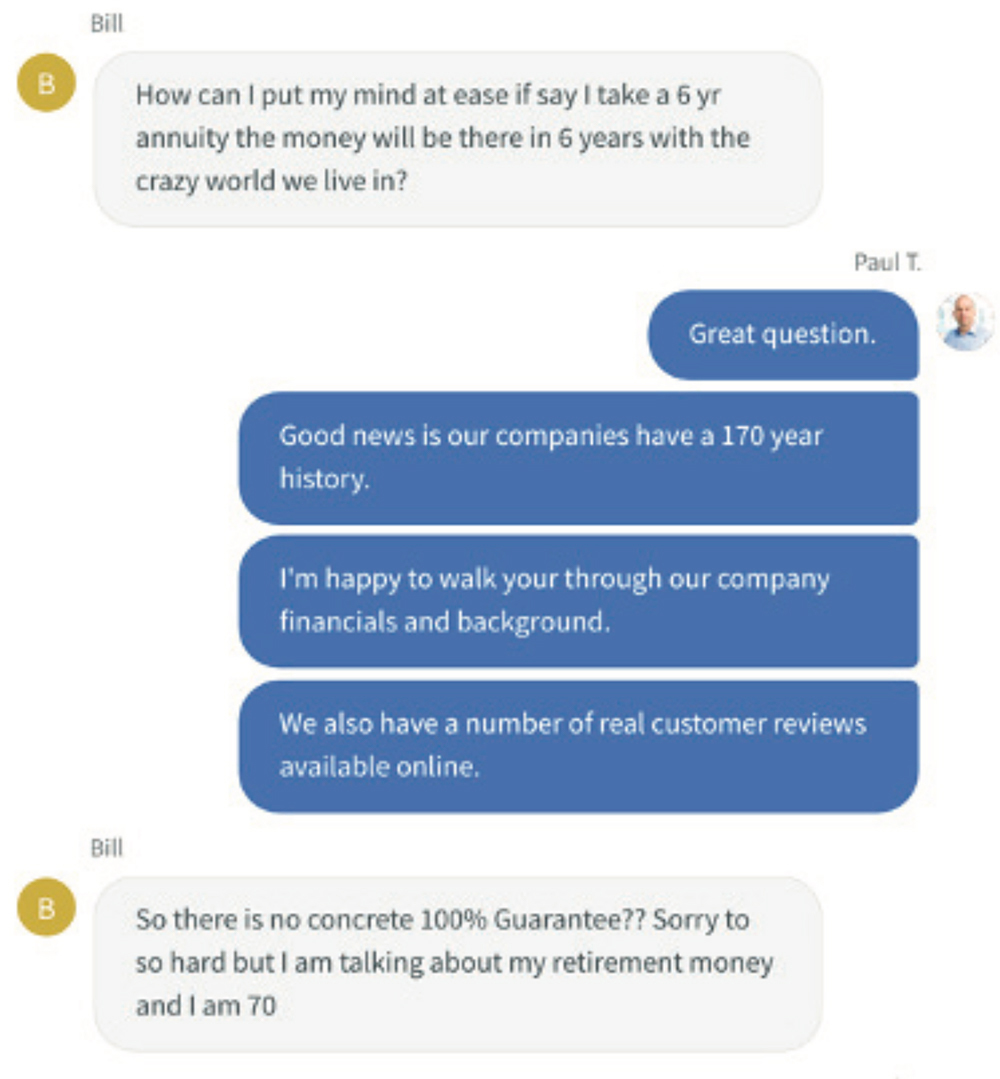

COVID-19 has slowly spread fear across the entire U.S. demographic focused on retirement-related issues. Those people with 401(k) plans have watched the balances grow during a very tumultuous period in U.S. history. However, high unemployment, political instability, high health care costs, and low interest rates have frightened many people. Those approaching retirement worry about losing their job before they can save enough to retire. Those in retirement watch interest paid on savings plummet and worry that the market will collapse. We hear these fears frequently even on our online chats with prospects and existing policyholders.

The latest release of a tracking poll by SimplyWise, in November, confirmed what we have qualitatively observed .3

From calls, emails, online chats and virtual meetings, we have heard individuals express four major fears that echo in this survey with quantitative precision:

Fear #1 – "Social Security won’t be here when I need it." In July 2020, 29% of Americans aged 70+ said they are concerned about Social Security drying up. This went up to 54% in September. In November, the number increased to 71%.

Fear #2 – "I will have to work until until I die." In May 2020, 65% of workers said they planned to work in retirement. In November, the number hit 75%.

Fear #3 – "I may get laid off before I want to retire.” 34% of Americans are now planning to change their investment strategy to keep more in cash accounts. They think bad things will happen.

Fear #4 – "I got laid off and no one will rehire me.” In September, 27% of people laid off said they hadn’t saved anything for retirement in the last year. This number jumped to just under 50% by November. In addition, 29% of 401(k) holders are now planning to withdraw early from that account to pay the bills.

How do we put people's minds at rest in a period of historic economic and technological dislocation? We identified eleven themes that could allow people to reset their financial outlook through new technology and new business models.

How to reduce fear and reset positive behavior

1 – Help me help you...As Jerry Maguire once said

As the airplane industry tells us, in case of an emergency, put on your own oxygen mask first, then help others. We, as an industry, should be focused on helping those who help themselves first. That means we should refresh and improve all the resources and digital tools that currently exist for the group of individuals who will really use them. As Victor Ricciardi, Washington & Lee University, said, "I can't save every student. You cannot save every client. Try to find the people that you can impact the most, change their behavior, and be a coach."

2 – Take advantage of the modern tech stack

The pandemic created a perfect storm that forced companies and agents to actually start to use the webcams that came bundled, at no extra charge, with most laptops for the last 10 years. Online applications and eSignatures finally achieved adoption rates over the 50% mark. That said, the industry still lags in applying widely available open-source technology that could provide customized, predictive online direction and advice at scale for a greater number of people. "When you think about the tools that are at our disposal - machine learning, big data, natural language processing - we haven't even really scratched the surface of those tools yet," said Jon Cooper, Founder and CEO of Life.io.

3 – Reinvent the new workplace as a savings catalyst

The workplace has historically played a critical role in creating the ability for many Americans to live comfortably. Pension benefits for many decades provided a reliable stream of income and inexpensive health care benefits for long-term employees lucky enough to receive them. As we moved from a defined benefit to a defined contribution environment, that role has diminished. However, with the mass adoption of remote work and increased use of video conferencing, employers have a new opportunity to play a lead role in helping not just workers, but entire families make the right decision. "Now that work is home and home is work in a lot of ways, the identification and the definition of a workplace has changed. One of the approaches we've taken from an HR perspective is wherever you're standing and working that’s your workplace," said Jacqueline Bamman, Chief People Officer of Nassau Financial Group.

4 – Meet the biggest savings needs of millennials first

We have all qualitatively heard that millennials desperately care about saving for retirement. However, many of them must first retire significant amounts of college debt before it even becomes possible to save for that future. As Jacqueline Bamman observed, "How do you get them to focus on their retirement when they're trying to pay off $300,000 in school loans?" The solution may be to divert matching retirement funds and turn those funds into loan repayments for the first 5 – 10 years of employment.

5 – Reward right actions one micro-step at a time

Forget about opening an IRA. Many people today need to start by simply building an emergency fund. That task alone may require a person to make little changes in spending each day that will cumulatively have a big impact. Omnipresent smartphones and smart watches create unique opportunities for employers, associations, planners, and carriers to nudge people to make the right long-term decisions. "But is there a future where some of these products start to shift and you get sort of micro rewards, incentives, nudges for doing the things that are right for you in the long run," said Debra Jasper, founder and CEO of Mindset Digital. Matthew Thomas, Infosys Retirement Center of Excellence agreed. "I think that we could apply that to life insurance anytime, or any savings, where you get some micro nudges, I think that’s absolutely critical," he said.

6 – Revisit how we present complex products

Greater use of smartphones, apps, and online tools create opportunities to explain complex products that never existed before. Only a few years ago, the industry believed that only very simple products like term life could be sold on the web. Today, a number of carriers actively explore selling annuities on the web. The increased use of mobile phones by seniors should only speed the evolution.

7 – Learn how to tell stories on the small screen

With the rapid increase in mobile phone usage by people over 55, we need be able to make a complex story even more simple than it may appear on a laptop. "The big skill is going to be to deliver information with big impact on a small screen. That will be a big shift," said Debra Jasper. We need to learn to simplify our language and shorten our explanations of how our products and solutions work. We need to rewrite nearly every platform to work on an Apple or Android device.

8 – Build barriers to prevent bad behavior

Surveys continue to show that people contemplate pulling money from their retirement accounts to address pressing financial needs. This can easily result in large tax penalties and threaten a long-term retirement savings plan. For now, it appears that front-line conversations with service centers and online education has prevented wide scale withdrawals. "A lot of people are thinking about it. The good news is what people are going online calling the call centers, they're not taking action on that at the levels that people were afraid of," said Matthew Thomas.

9 – Reframe the conversation

It's now more important than ever to focus individuals on a vivid vision of the impact of their action. If you frame a discussion to someone who likes to go on cruises, when they want to buy a car, you say, "You're going to have $2,000 a month, you'll be able to go on two extra cruises in retirement per year," suggested Vic Ricciardi. We need to create new pictures in people’s heads of the still-possible positive outcomes. We’re bullish on augmented reality and virtual reality as a way to engage in a more impactful manner.

10 – Give people the tools to learn the way they learn best

People learn in very different ways. Online tools give people the opportunity to learn through words, sounds, video, and even VR. However, some simply need to learn in person. We need to bring all high-quality forms of interactive education and engagement to bear in the new environment.

11 – Retrain the advisors to succeed in the online world

Delivering complex products and solutions to consumers still typically requires the need for real people to complete the transaction. We generally call those real people agents or advisors. We just need to teach them new skills to thrive in the new world. "So I think that to do this well, we have to start to help advisors apply strong narrative in Zoom meetings. If you think about reading a good book or any kind of good story, you have to have a powerful opening. Advisors are going to have to learn how to have a powerful ending in a virtual world. There are small things we can do," said Jasper. This will require advisors to rebrand themselves on the web and social media and likely adopt a new set of tools to help them attract, engage, and interact with the next wave of clients.

Appreciation

We want to thank our distinguished panel for framing the discussion:

We also want to the thank all the retirement industry leaders who joined us for this event and shared their unique insight on problems to solve and their investment opportunities. Also, this event could not have occurred without the leadership of Laura Dinan Haber, Program Manager of Nassau Re/Imagine, Ramsey Smith, Founder and CEO of ALEX.fyi, and the marketing team of Nassau Financial Group. Support and funding comes from Nassau Financial Group, Launc[H] and Symetra.

About the Author

Paul Tyler serves as the Chief Marketing Officer for Nassau Financial Group. He leads the branding, marketing, and digital engagement for the company. He founded the incubator Nassau Re/Imagine in 2020 as a place to help companies create the future of insurance today.

About Re/Imagine

Nassau Re/Imagine serves as incubator for companies intending to build a presence in Hartford. We actively support individuals and team committed to building a vibrant insurtech ecosystem in the heart of our insurance community.

Forum Series Sponsors

Opinions expressed in this document reflect only those of participants and do not necessarily express the views or opinions of their employers or our sponsors.

Symetra® is a registered service mark of Symetra Life Insurance Company.

1 Saving for the future self: Neural measures of future self-continuity predict temporal discounting, Hal Ersner- Hershfield, G. Elliott Wimmer, and Brian Knutson, 2009, https://static1.squarespace. com/static/5dd05454f1a7771855d537b7/ t/5deeaed32d94c967c146bb 3b/1575923414660/Ersner-Hershfield_ Wimmer_Knutson_2009_SCAN.pdf

2 "Transamerica Joins Prudential in Ditching Rate-Sensitive Products”, Life Annuity Specialist, December 11, 2020, https://www.lifeannuityspecialist. com/c/2992303/374783/transamerica_ joins_prudential_ditching_rate_ sensitive_products?referrer_ module=issueHeadline&module_order=1

3 November 2020 Retirement Confidence Index, SimplyWise, https://www. simplywise.com/blog/retirement- confidence-index/

NASSAU REIMAGINE

NASSAU REIMAGINE

![Launc[H] Launc[H]](https://imagine.nfg.com/wp-content/uploads/2021/07/launchartford.jpg)